ohio sales tax exemption form example

Printing and scanning is no longer the best way to manage documents. If the seller is located in Ohio or the out-of-state seller has substantial nexus with Ohio sales or use tax is due on all sales of tangible personal property and selected services to purchasers in.

Full Ust 1 Data File Upload Department Of Taxation

Ohio Sales Tax Exemption Form.

. Fill out the Ohio sales. Obtain an Ohio Vendors License. Therefore you can complete the Ohio sales tax exemption certificate form by providing your Sales Tax Number.

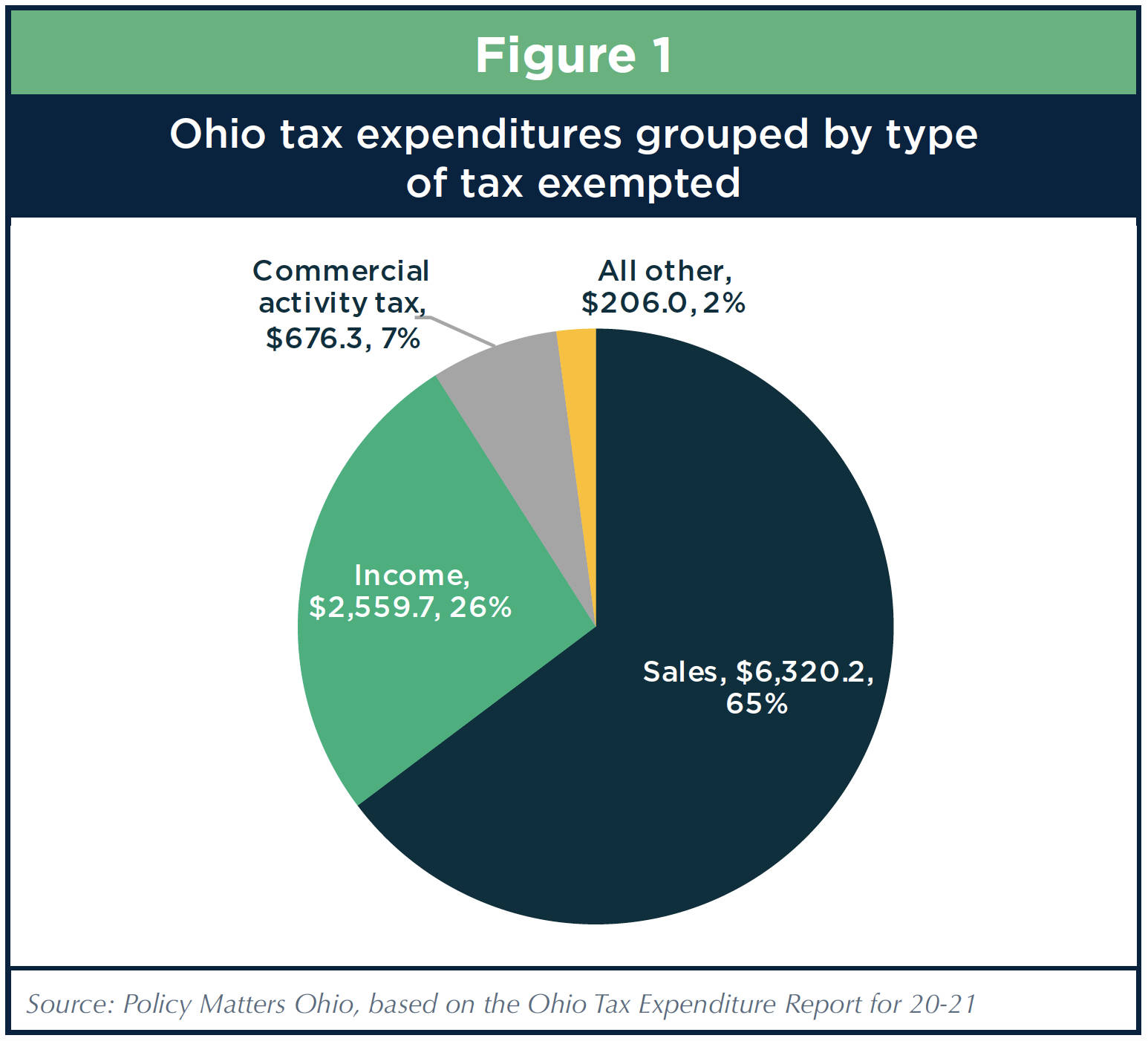

Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Additionally counties and other municipalities can add discretionary sales and use tax rates.

Ohio Sales Tax Exemption Certificate. For example at industry shows. Save yourself time and money using our fillable web templates.

Access the forms you need to file taxes or do business in Ohio. Ohios back-to-school sales tax-free holiday is back this weekendIn 2019 Senate Bill 226 allowed for a permanent sales tax holiday on the first Friday Saturday and Sunday of August each. Real property under an exempt construction contract.

In transactions where sales. Construction contractors must comply with rule 5703-9-14 of the. Go digital and save time with signNow the best solution for.

Enter a full or partial form number or. Get tax exempt form ohio signed right from your smartphone using these six tips. Ohio also has several additional taxes for certain.

Handy tips for filling out Sales tax exemption form online. State Of Ohio Sales And Use Tax Blanket Exemption Form Taxation Exemption Types arrive in many different forms. On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property.

Some examples are the Contractors Exemption Official. The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple. This certi cate cannot be used by construction contractors to purchase material for.

Sales and Use Tax Blanket Exemption Certificate. Otherwise purchaser must comply with either rule 5703-9-10 or 5703-9-25 of the Administrative Code. Ohios state sales tax rate is 575 percent.

This form may be obtained on the website of the Streamlined Sales Tax Project. Sale Tax Exempt Form Ohio - Sale Tax Exempt Form Ohio - In order to be exempt from sales tax an employee must be able to make sales.

Health Freedom Ohio Vaccine Laws And Info

Free Vaccine Exemption Form Free To Print Save Download

How To Become Ebay Tax Exempt A Complete Guide

Stec U Fill Out Sign Online Dochub

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

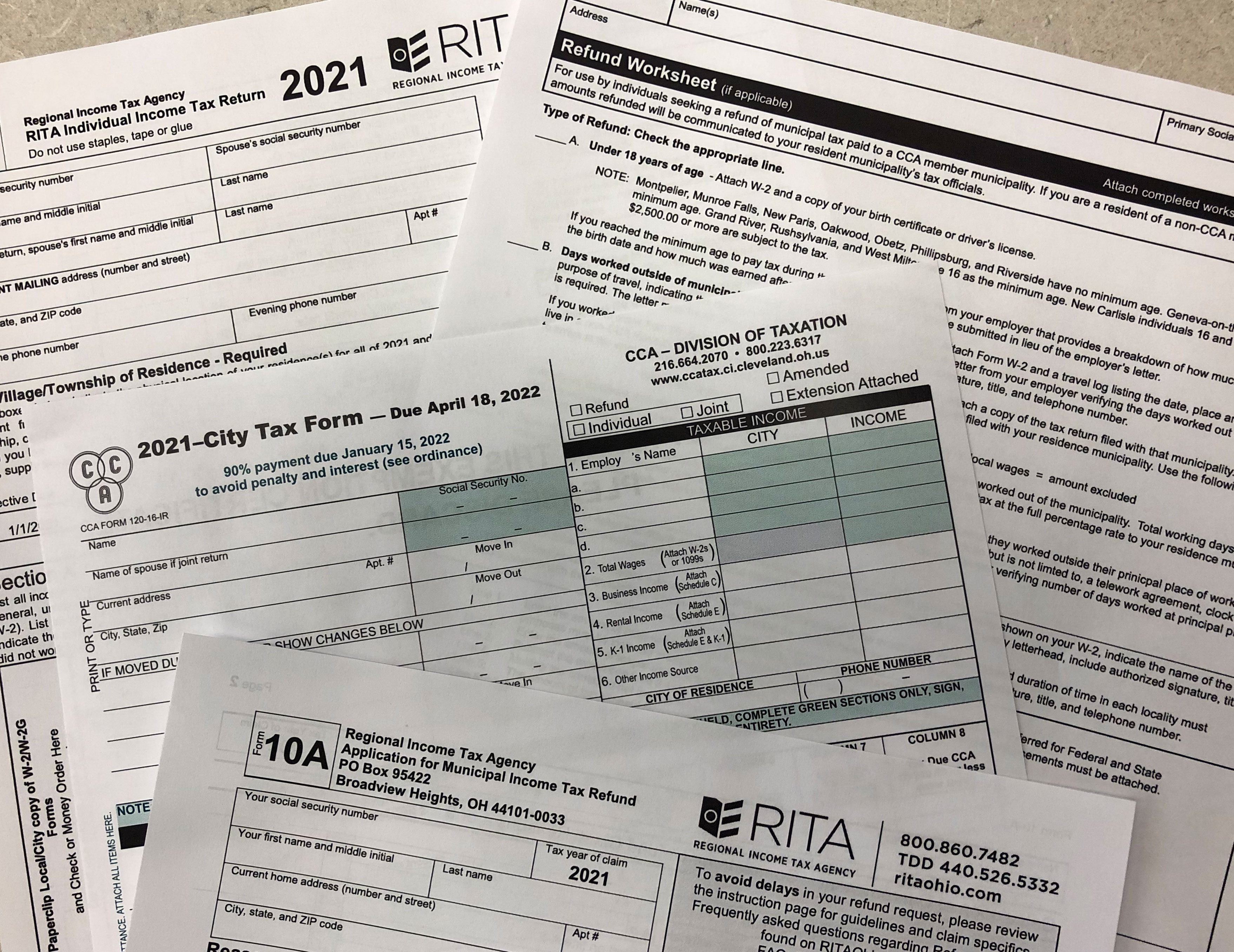

Q A Here S How Working From Home Could Change Your 2022 City Tax Withholdings And Bills Cleveland Com

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

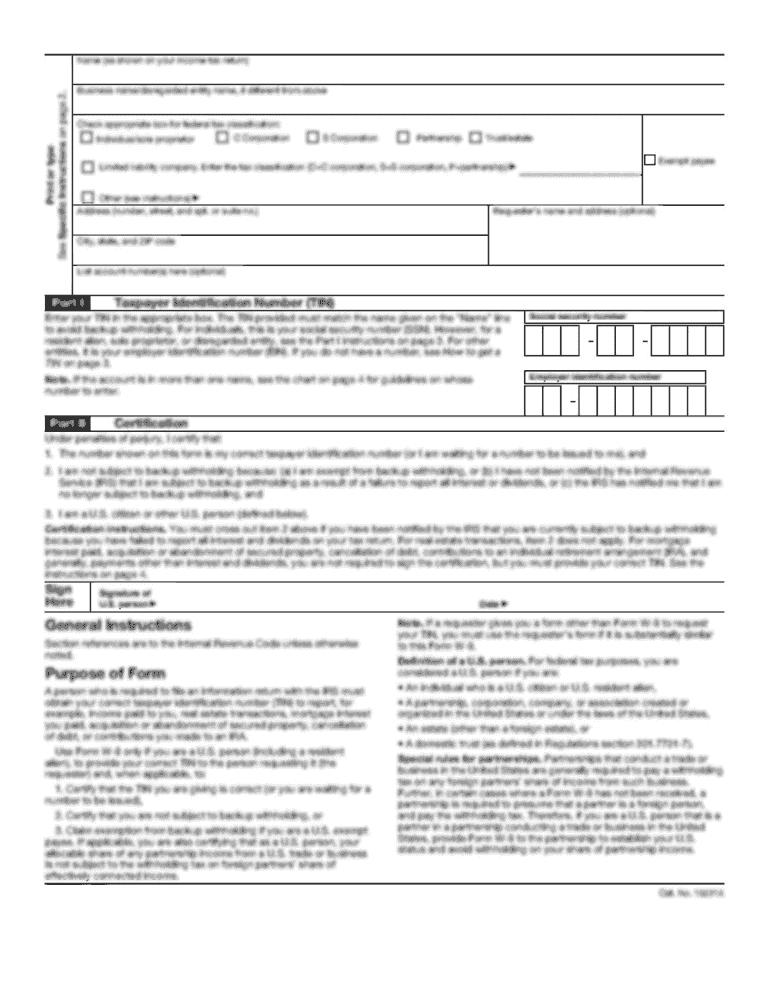

W 4 Form How To Fill It Out In 2022

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Changes Coming To Ohio S Real Property Tax Exemption Laws

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Country Mfg Ohio Tax Exemption Form Faxable

Ohio Sales Tax Exemptions Agile Consulting Group

Sales Taxes In The United States Wikipedia

Ohio Form W 2 School District Reporting Starts With 2016 Tax Year